25+ self employment mortgage

Conventional loans are the most common option but have the strictest requirements. Web Fortunately self-employed borrowers are eligible for virtually all of the same mortgage types available to others.

Mortgages For Self Employed Borrowers Tips To Qualify

Web Mortgage lenders define self-employed borrowers as anyone who is not a W-2 employee or one with 25 or more ownership interest in a business.

. Youll need to provide tax returns and financial statements to prove. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following. Use NerdWallet Reviews To Research Lenders.

Take Advantage And Lock In A Great Rate. Highest Satisfaction for Mortgage Origination. That means you can qualify for a conventional loan.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web Self-Employed Mortgage Options FHA loan. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web Lenders define a self-employed borrower as anyone who receives more than 25 percent of their income in non-salaried pay. Web Mortgage Loans For Self-Employed Options Conventional Loans. Getting a mortgage as a self-employed person can be more difficult because you have to prove you have a reliable.

However mortgage lenders will require you to provide additional documentation for the. Take Advantage And Lock In A Great Rate. Who qualifies for a self-employed.

The following factors must be analyzed before. A Federal Housing Administration FHA loan is a mortgage that is insured by the Federal Housing. Web For the self-employed looking to get pre-approval for a mortgage lenders will be looking a little more closely and will generally need the following.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Use NerdWallet Reviews To Research Lenders. Web Any individual who has a 25 or greater ownership interest in a business is considered to be self-employed.

Web Lenders will view you as self-employed if you own more than 20 to 25 of a business from which you earn your main income. Web If you earn more than 25 of your income from a business lenders consider you self-employed. Save Real Money Today.

Web Self-employed mortgages can be more complex than someone in full-time employment purely because the way you prove your income is different. Web Lenders usually offer a self-employed mortgage to qualified borrowers looking to buy a house with a more unique income situation. Web Yes you can get a mortgage if youre self-employed.

Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web Youre considered self-employed if you own 25 or more of a business. Apply Online To Enjoy A Service.

Web Mortgage lenders typically define self-employed as an individual with an ownership interest of 25 or greater in a business. Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best. Web A self-employed mortgage fundamentally requires your Notices of Assessment and Income Tax Statement T1.

You could be a sole trader company director or. This is the basics for how to qualify for a. An individual whos not a W-2.

Bni Loan Qualification 101

Getting A Mortgage When You Re Self Employed Moving Com

Rd8fjlqpks3pkm

Mortgage Pre Approval Burlington Oakville Hamilton Milton On

2023 Mortgage Guide For The Self Employed Moneygeek Com

Self Employed Home Loan Options

Self Employed Mortgage Loan Requirements 2023

Ygk Mortgages Ygkmortgages Twitter

Mortgage Broker In Ontario Butler Mortgage

1099 And Self Employed Borrowers Mortgage Guidelines Youtube

Top 25 Mortgage Brokers In Melbourne 2022

Can You Get A Mortgage If You Re Self Employed Mortgages And Advice U S News

Guide For Self Employed Mortgage Applicants Barclays

Buying A Home Columbia Mo Real Estate Blog Showmecomo Com

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

Self Employed Home Loans Explained Assurance Financial

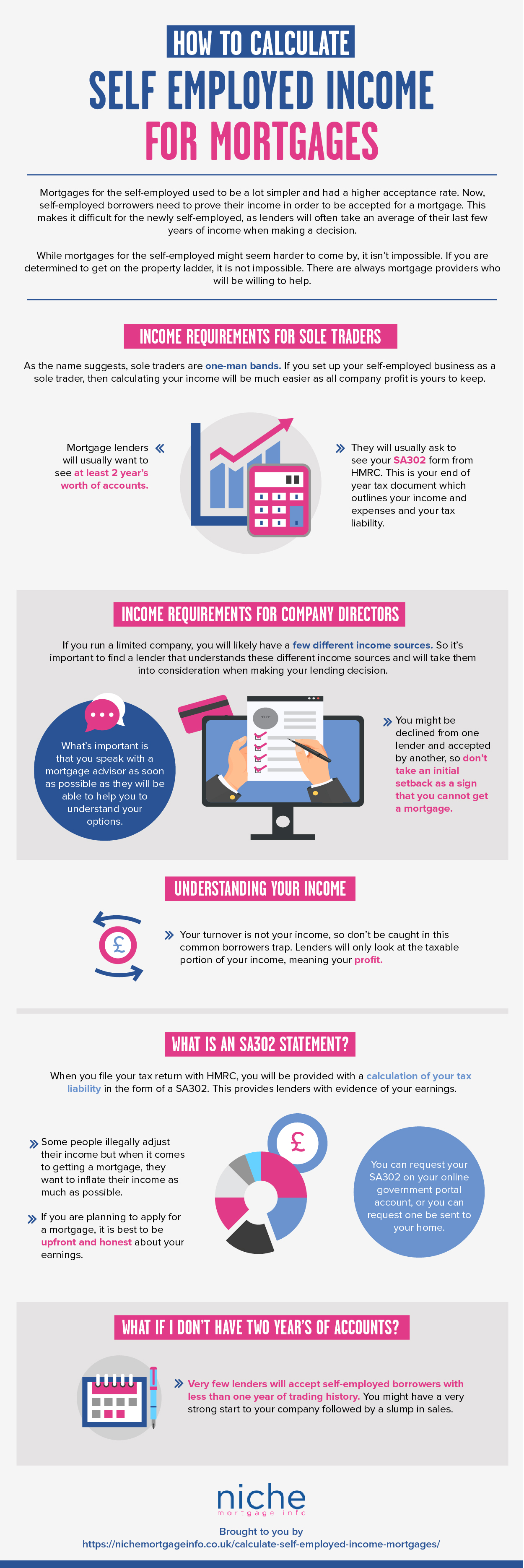

Mortgage Lenders Income Requirements For The Self Employed Niche